Cac40 Fintechzoom – Dive Into The Information!

The CAC 40, short for “Cotation Assistée en Continu,” is the benchmark stock market index of France’s Euronext Paris stock exchange.

Comprising the 40 largest publicly traded companies in France based on market capitalization, the CAC 40 is a crucial indicator of the performance of the French equities market and the broader economy.

FintechZoom’s coverage of the CAC 40 index, France’s stock market benchmark, for insights on market trends, company performance, and investment opportunities.

Dive into FintechZoom’s analysis of the CAC 40 index to uncover market trends, track company performance, and seize investment opportunities in France’s dynamic equities market.

Table of Contents:

Understanding The Cac 40 Index – Click For The Complete Guide!

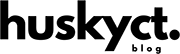

Launched in 1987 with a starting value of 1,000, the CAC 40 index utilizes a market capitalization-weighted methodology, where companies with higher market values wield more influence over their fluctuations.

This approach ensures that the index accurately reflects the performance of France’s largest publicly traded companies.

Quarterly reviews are conducted to maintain the index’s relevance and alignment with the evolving dynamics of the French stock market, ensuring that it remains a reliable barometer of investor sentiment and economic conditions.

The CAC 40 index boasts diverse constituents spanning various sectors, including finance, energy, consumer goods, and technology. This breadth of representation exposes investors to various industries, allowing them to diversify their portfolios and mitigate risk.

The index encompasses France’s most prominent and influential companies, from global conglomerates like TotalEnergies and L’Oréal to pharmaceutical giants like Sanofi.

As a result, investors, analysts, and policymakers closely watch movements in the CAC 40 index, serving as a bellwether for the broader French equities market.

Fintechzoom’s Coverage Of The Cac 40 – Get Informed In A Snap!

FintechZoom is renowned for its extensive coverage of the CAC 40 index, offering investors a wealth of up-to-date information on market performance, stock prices, and company news.

Through its intuitive online platform and mobile app, FintechZoom provides users with real-time data and in-depth analysis, empowering them to make informed decisions about their investment strategies.

FintechZoom’s team of seasoned financial experts delves into the intricate factors influencing movements in the CAC 40 index, from overarching macroeconomic trends to nuanced company-specific developments.

Be it a significant merger announcement, a pivotal shift in government policy, or the release of crucial quarterly earnings reports, FintechZoom ensures that investors remain well-informed.

The latest events are shaping the CAC 40 and its constituent companies, enabling them to navigate the markets with confidence and precision.

Read Also: Jaart011 – A Guiding Light To A World Of Possibilities!

Investment Opportunities In The Cac 40 – Discover More Right Away!

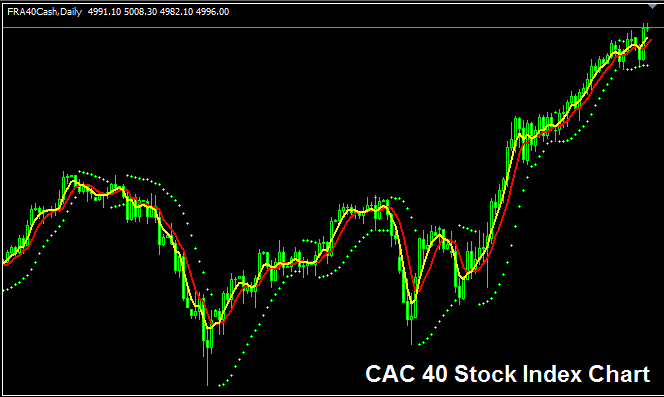

For investors seeking entry into the French equities market, the CAC 40 index is an accessible and diversified investment avenue.

Exchange-traded funds (ETFs) and index funds that mirror the CAC 40 provide a straightforward means for investors to participate in the index’s performance, granting broad exposure to France’s leading companies.

Moreover, individual stocks within the CAC 40 index offer opportunities for active investors to leverage specific market trends and company advancements.

Through meticulous research and analysis, investors can pinpoint undervalued firms poised for growth or position themselves in established industry frontrunners boasting stable earnings and dividends.

The CAC 40 index is a gateway for investors to access the French equities market, offering passive and active investment opportunities.

ETFs and index funds provide a hands-off approach for those seeking diversified exposure, while individual stock selection caters to investors keen on strategic positioning and capitalizing on market dynamics.

Whether pursuing a long-term investment strategy or seizing short-term trading opportunities, the CAC 40 index affords investors a versatile platform to engage with the dynamic landscape of French equities.

Read Also: Fallout 76 Crossplay – Unlocking Boundaries With Us!

Fintechzoom’s Educational Resources – Click For Essential Information!

FintechZoom’s robust array of educational resources, spanning articles, tutorials, and webinars, is valuable for investors seeking to enhance their comprehension of the CAC 40 index and refine their investment approaches.

Whether a seasoned investor or a novice, FintechZoom offers the necessary tools and insights to navigate the intricacies of the French equities market and realize financial objectives.

By leveraging these educational materials, investors can better understand market dynamics, refine their analytical skills, and cultivate effective investment strategies tailored to their goals and risk profiles.

With FintechZoom’s comprehensive educational offerings, investors can confidently embark on their investment journey, equipped with the knowledge and expertise needed to make informed decisions in the ever-evolving landscape of the CAC 40 index.

Whether delving into fundamental analysis techniques, exploring market trends, or honing their portfolio management skills, FintechZoom empowers investors to take control of their financial futures and unlock the potential for long-term success in the French equities market.

Read Also: Sdmc Webnet – A Comprehensive Guide In 2024!

Conclusion:

“FintechZoom: Your go-to for navigating CAC 40 and French equities. Real-time data and educational tools empower confident investment decisions.”

FAQS:

1. What is the CAC 40 index?

The CAC 40 index is a benchmark stock market index representing the 40 largest publicly traded companies listed on the Euronext Paris stock exchange.

2. How is the CAC 40 index calculated?

The CAC 40 index is calculated using a market capitalization-weighted methodology. Companies with higher market values have a greater impact on the index’s movements.

3. What sectors are represented in the CAC 40 index?

The CAC 40 index includes companies from various sectors, including finance, energy, consumer goods, technology, and healthcare.

4. How can I invest in the CAC 40 index?

Investors can gain exposure to the CAC 40 index through exchange-traded funds (ETFs) and index funds that track its performance.

5. What does FintechZoom offer in terms of CAC 40 coverage?

FintechZoom provides comprehensive coverage of the CAC 40 index, offering real-time data, analysis, and educational resources to help investors understand market trends and make informed investment decisions.

6. How can I access FintechZoom’s coverage of the CAC 40 index?

You can access FintechZoom’s coverage of the CAC 40 index through its online platform and mobile app, where you’ll find articles, tutorials, webinars, and real-time market data.

Read Also: